When many businesses are battling inflation, affording that next upgrade is top of mind. Many businesses, especially small or newly established ones, may not have sufficient cash reserves to make a substantial down payment. Depending on the lender, there are options to keep costs low and get equipment.

Some alternative options include...

- 100% Financing

- Trade-in Equipment

- Step Payments

- Friendly and Convenient Financing Guidance

100% Financing

Well-qualified buyers could qualify for 100% financing. This means the equipment has no initial payment required. Get financing with no money down frees up liquidity for operating expenses and investing in crucial areas of your business. However, start-up businesses, younger businesses and/or challenged credit may not qualify for 100% financing.

See if you qualify by applying for flexible financing here.

Trade-in Equipment

Have equipment you no longer need? By using the trade-in value as a down payment, businesses increase their equity in the new equipment from the start. This can lead to more favorable financing terms.

The value of the traded-in equipment is applied towards the purchase price of the new equipment, effectively reducing the amount of cash needed for the down payment. This makes the acquisition more affordable and lessens the financial burden on the business.

How to Get Started:

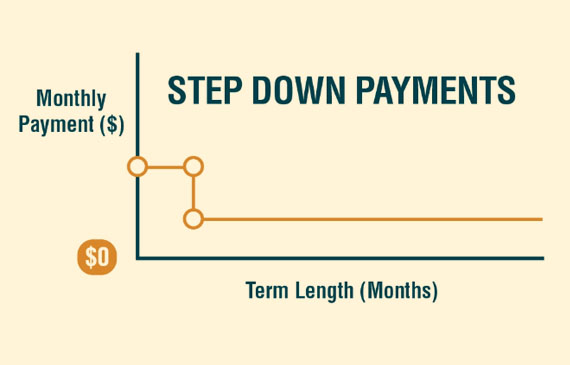

Step Payments

Step payments are a possible solution to help mitigate a down payment. Unlike a traditional financing structure, where the payment is the same each month, step-down payments are higher upfront and decrease over time. This option allows us to offset the financing costs to effectively lower your monthly payments for the bulk of your loan.

Give your business time to ramp up, train employees, save cash, and network. Your first 3 to 6 payments can be a higher or lower amount than the remaining stream of payments, depending on your need.

To get the needed equipment to optimize your business, you can apply for step payments here.

Friendly and Convenient Financing Guidance

We've only scratched the surface on what flexible financing options are available. The key to unlocking the right program for your business lies within that initial discovery call with your financing specialist. Depending on your credit profile and what you're trying to achieve, your financing consultant can help get the right payment for your business.

Your rep will strive to find the flexible financing program that's right for the ups and downs of your business. To learn more about flexible financing options available to you, visit www.beaconfunding.com/businessgoals